|

| Debt Ceiling Increases by Presidents - Congressional Budget Office - Photo by Thinkprogress.org |

The Debt Limit: History and Recent Increases

CRS Report for Congress

Prepared for Members and Committees of Congress

This report, of which we are using excerpts was completed by the Congressional Research Service.

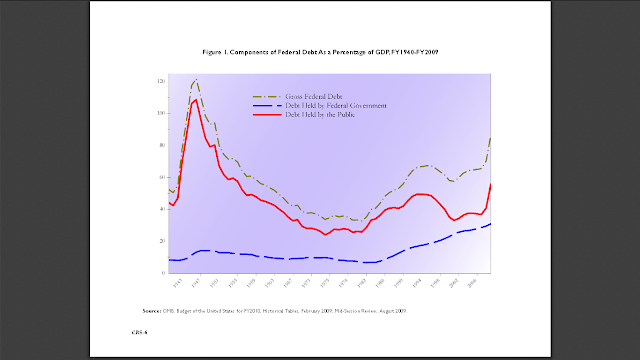

In an effort to explain what the Debt Limit (or Ceiling) is, the history of Debt Ceiling increases, why they are needed, and why they are normally a formality excepts of this report by the Congressional Research Service will be used. In the chart above, prepared by the Congressional Budget Office, you can see that under President George W. Bush the debt ceiling was raised by 90.2% for the years 2001-2009. President Obama has increased the debt ceiling 26.3% from 2009 until the present. But before we get to heavily into the numbers we will talk about the history.

Why Have a Debt Limit?

The debt limit can hinder the Treasury’s ability to manage the federal government’s finances. In extreme cases, when the federal debt is very near its statutory limit, the Treasury must take unusual and extraordinary measures to meet federal obligations. While the debt limit has never caused the federal government to default on its obligations, it has at times caused great inconvenience and has added uncertainty to Treasury operations. The debt limit also provides Congress with the strings to control the federal purse, allowing Congress to assert its constitutional prerogatives to control spending. The debt limit also imposes a form of fiscal accountability that compels Congress and the President to take visible action to allow further federal borrowing when the federal government spends more than it collects in revenues. In the words of one author, the debt limit “expresses a national devotion to the idea of thrift and to economical management of the fiscal affairs of the government.” On the other hand, some budget experts have advocated elimination of the debt limit, arguing that other controls provided by the modern congressional budget process established in 1974 have superseded the debt limit, and that the limit does little to alter spending and revenue policies that determine the size of the federal deficit.

A Brief History of the Federal Debt Limit

Origins of the Federal Debt Limit

The statutory limit on federal debt began with the Second Liberty Bond Act of 1917, which helped finance the United States’ entry into World War I. By allowing the Treasury to issue long-term Liberty Bonds, which were marketed to the public at large, the federal government held down its interest costs. Before World War I, Congress authorized specific loans, such as the Panama Canal loan, or allowed the Treasury to issue specific types of debt instruments, such as certificates of indebtedness, bills, notes and bonds. In other cases, Congress provided the Treasury with limited discretion to choose debt instruments. With the passage of the Second Liberty Bond Act, Congress enacted aggregate constraints on certificates of indebtedness and on bonds that allowed the Treasury greater ability to respond to changing conditions and more flexibility in financial management. Debt limit legislation in the following two decades also set separate limits for different categories of debt, such as bills, certificates, and bonds. In 1939, Congress eliminated separate limits on bonds and on other types of debt, which created. This measure gave the Treasury freer rein to manage the federal debt as it saw fit. Thus, the Treasury could issue debt instruments with maturities that would reduce interest costs and minimize financial risks stemming from future. On the other hand, although the Treasury was delegated greater independence of action, the debt limit on the eve of World War II was much closer to total federal debt than it had been at the end of World War I. For example, the 1919 Victory Liberty Bond Act (P.L. 65-328) raised the maximum allowable federal debt to $43 billion, far above the $25.5 By contrast, the debt limit in 1939 was $45 billion, only about 10% above the $40.4 billion total federal debt of that time.

World War II and After

The debt ceiling was raised to accommodate accumulating costs for World War II in each year

from 1941 through 1945, when it was set at $300 billion. After World War II ended, the debt limit was reduced to $275 billion. Because the Korean War was mostly financed by higher taxes rather than by increased debt, the limit remained at $275 billion until 1954. After 1954, the debt limit was reduced twice and increased seven times, until March 1962 when it again reached $300 billion, its level at the end of World War II. Since March 1962, Congress has enacted 74 separate measures that have altered the limit on federal debt. Most of these changes in the debt limit were, measured in percentage terms, small in comparison to changes adopted in wartime or during the Great Depression. Some recent increases in the debt limit, however, were large in dollar terms. For instance, in May 2003, the debt limit increased by $984 billion.

Summary of the Report

Total debt of the federal government can increase in two ways. First, debt increases when the government sells debt to the public to finance budget deficits and acquire the financial resources needed to meet its obligations. This increases debt held by the public. Second, debt increases when the federal government issues debt to certain government accounts, such as the Social Security, Medicare, and Transportation trust funds, in exchange for their reported surpluses. This increases debt held by government accounts. The sum of

debt held by the public and debt held by government accounts is the total federal debt. Surpluses generally reduce debt held by the public,while deficits raise it.

The Debt Ceiling in the Last Decade

During the four years (FY1998-FY2001) the government ran surpluses, federal debt held by intergovernmental accounts grew by $855 billion and debt held by the public fell by almost $450 billion. Since FY2001, however, debt held by the public has grown due to persistent and substantial budget deficits. Debt held in government accounts also has grown, in large part because Social Security payroll taxes have exceeded payments of beneficiaries. Table 1 shows components of debt in current dollars and as percentages of gross domestic product (GDP).

|

Table 1. Components of Debt Subject to Limit, FY1996-FY2009

(in billions of current dollars and as percentage of GDP)

|

Components of Federal Debt As a Percentage of GDP, FY1940-FY2000

|

Figure 1. Components of Federal Debt As a Percentage of GDP, FY1940-FY2009

|

The report then explains how debt limit issues from 2002-2007. The table below shows increases in the debt limit since 2000.

|

Table 2. Increases in the Debt Limit Since January 2000

|

Concluding Comments

Since the late 1950s, the federal government increased its borrowing from the public in all years,

except in FY1969 following imposition of a war surcharge and in the period FY1997-FY2001.

The persistence of federal budget deficits has required the government to issue more and more

debt to the public. The accumulation of Social Security and other trust funds, particularly after

1983 when recommendations of the Greenspan Commission were implemented, led to sustained

growth in government-held debt subject to limit. The growth in federal debt held by the public

and in intergovernmental accounts, such as trust funds, has periodically obliged Congress to raise

the debt limit. Between August 1997, when the debt limit was raised to $5,950 billion, and the beginning of

FY2002 in October 2001, federal budget surpluses reduced debt held by the public. From the end

of FY2001, the last fiscal year with a surplus, until the end of FY2008, debt held by the public

subject to limit grew by $2,484 billion. Federal debt held in intergovernmental accounts grew

steadily throughout the period, rising by $1,743 billion since the beginning of FY 2002

The Bottom Line:

Raising the Debt Ceiling Should Not Be a Bargaining Chip and Held Hostage in Lieu of a Government Shutdown

The Republican controlled House of Representatives has now voted on bills to send to the Senate that include delaying the Affordable Care Act for one year, which President Obama has already said he would allow.Senate Democratic leadership said they will not accept this language, pushing the federal government a step closer to a government shutdown on Oct. 1. The vote was 231-192 with 2 Republicans voting against and 2 Democrats voting for the measure.

Shutting down the government is not the answer, and most Republicans know that this will hurt their party but the extremist Tea Party members have tunnel-vision and simply, don't care. Contact your Congressmen and Senators and tell them to work it out. Raising the debt ceiling does NOT give authority to spend more money, it only allows America to pay the bills it has already accrued.

To find and contact your Senators use this link: http://www.senate.gov/general/contact_information/senators_cfm.cfm

To find and contact your Congressmen use this link: http://www.house.gov/representatives/

Do it now. Send an e-mail or make a call. People can get things done when they come together and make contact with their representatives.

No comments:

Post a Comment

We appreciate hearing your opinions